Fabulous Tips About Petty Cash Debit Or Credit In Trial Balance

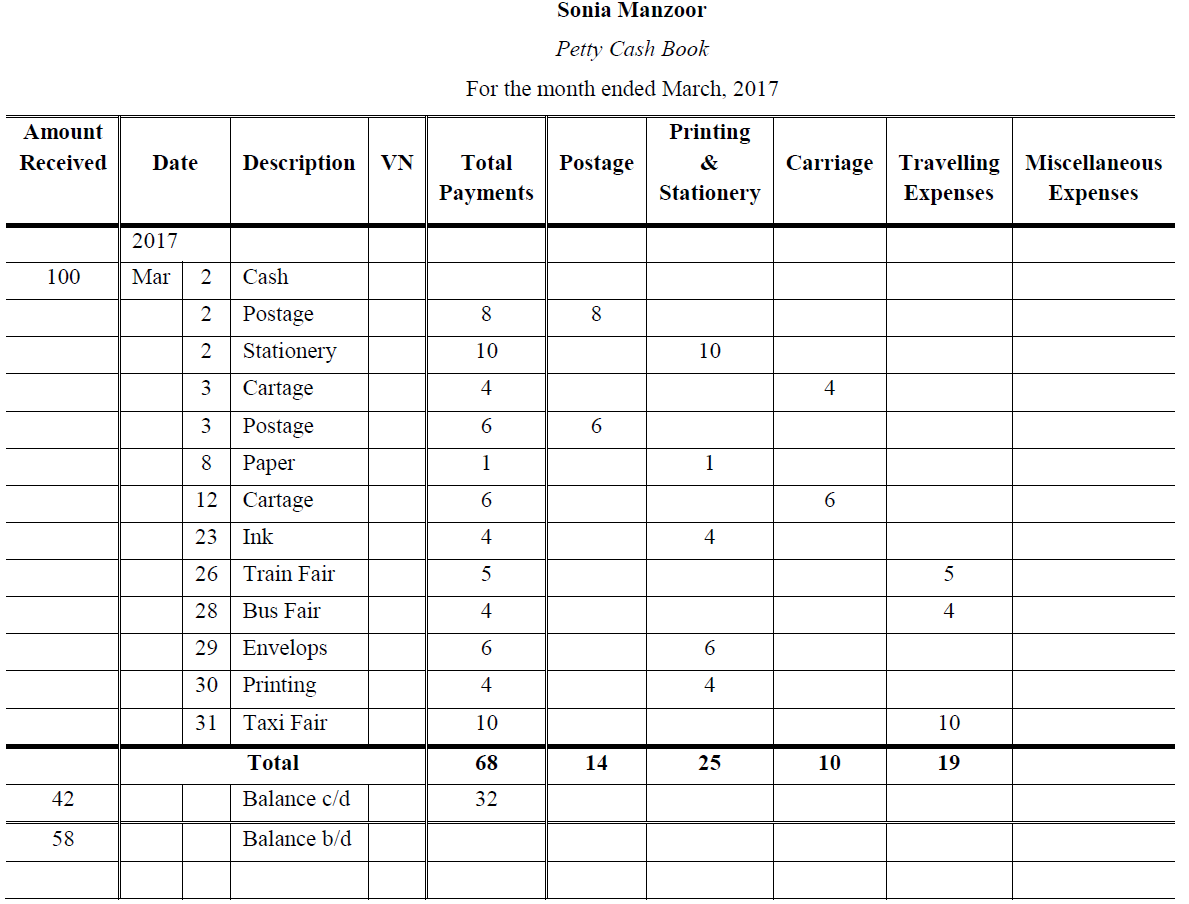

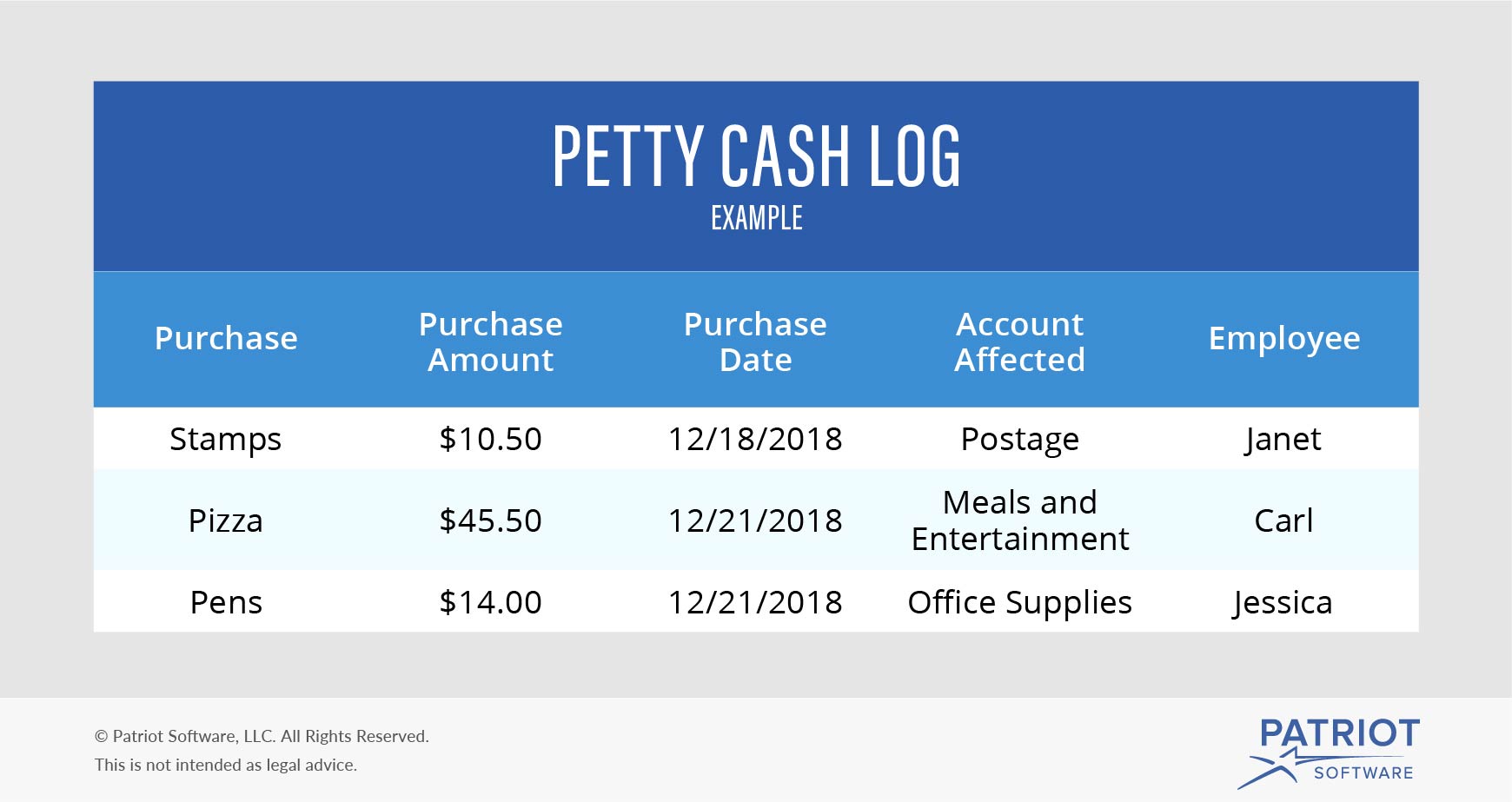

You typically evaluate your petty cash fund at the end of each month for more accurate balances.

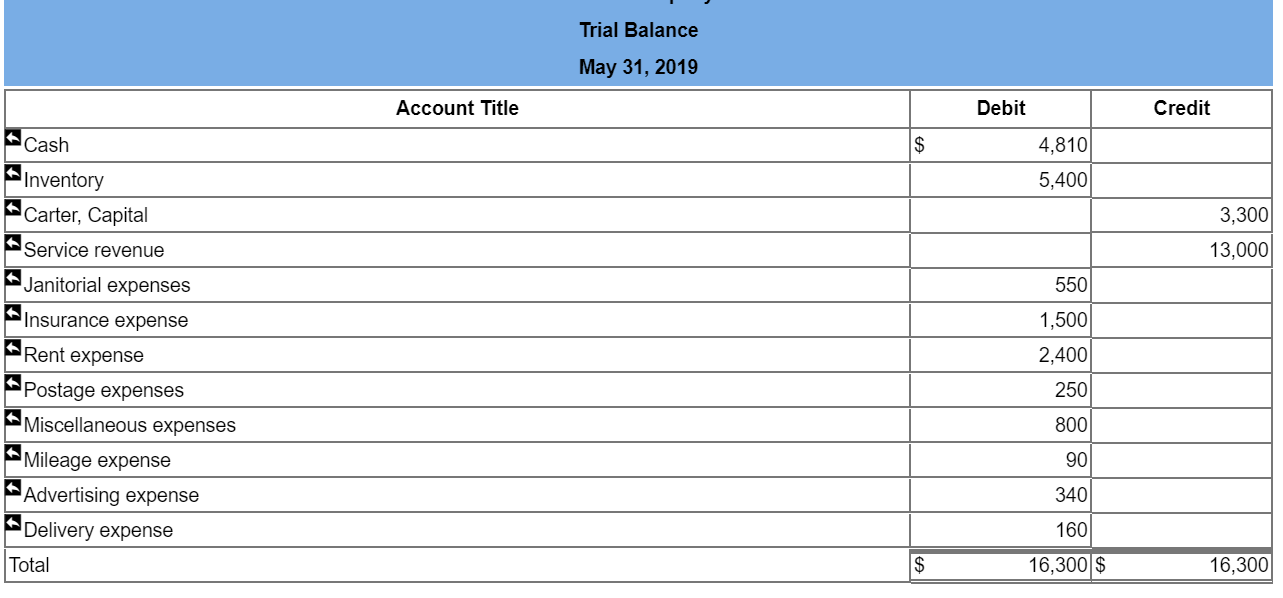

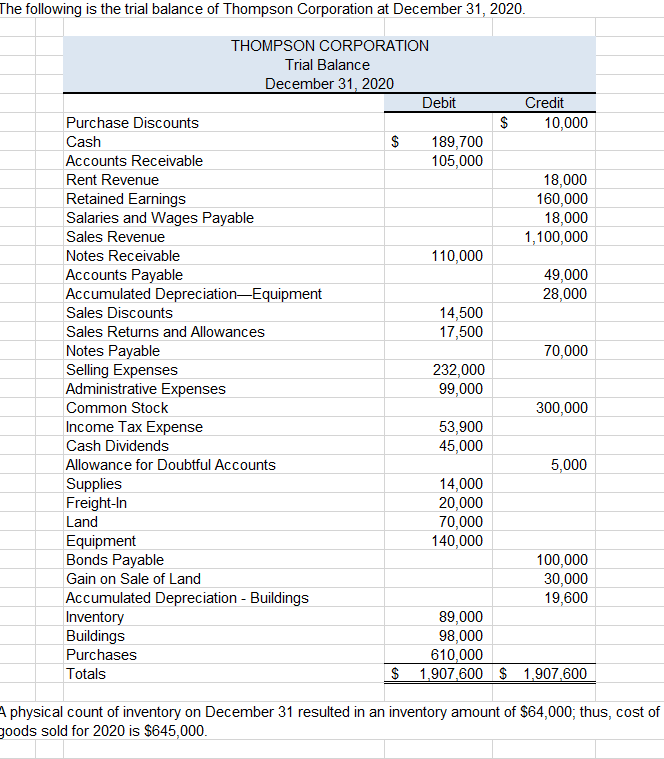

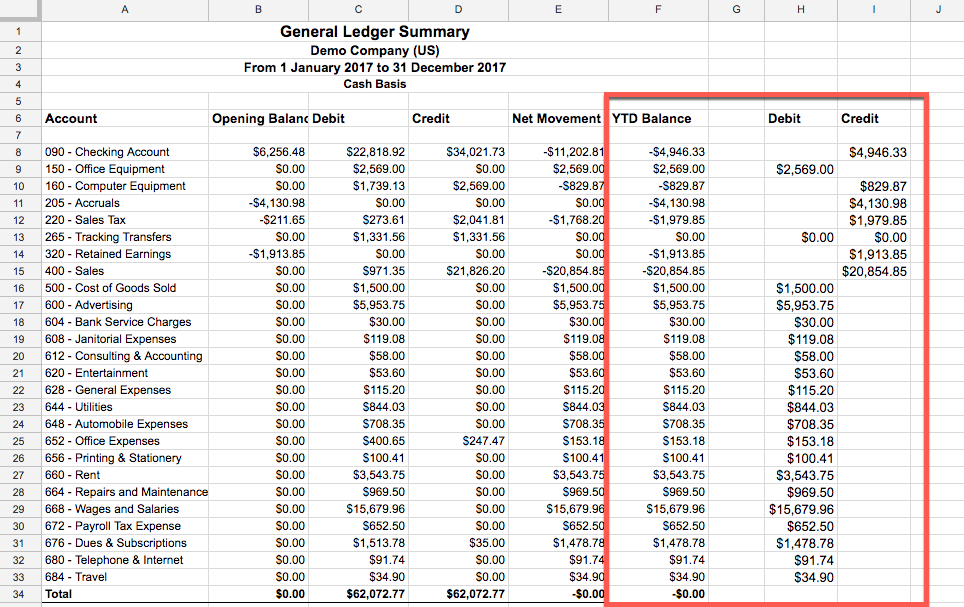

Petty cash debit or credit in trial balance. It is a statement prepared at a certain period to check the arithmetic accuracy of the accounts (i.e.,. If the final balance in the ledger account (t. The term trial balance refers to the total of all the general ledger balances.

Agency purchased additional supplies during the month for $2,500. Expenses and assets are accounted for as debit balances, while income and liabilities. I believe that the trial balance would not match as an impact of omitting petty cash book balance of $500.

Petty cash is a debit so i thought petty cash. She also found that the debits exceeded the. Is cash debit or credit?

Can someone explain why petty cash control is a debit? Cash is the company’s current assets holding for small expenses in the office or for a. Now post these balances into the trial balance’s credit and debit columns.

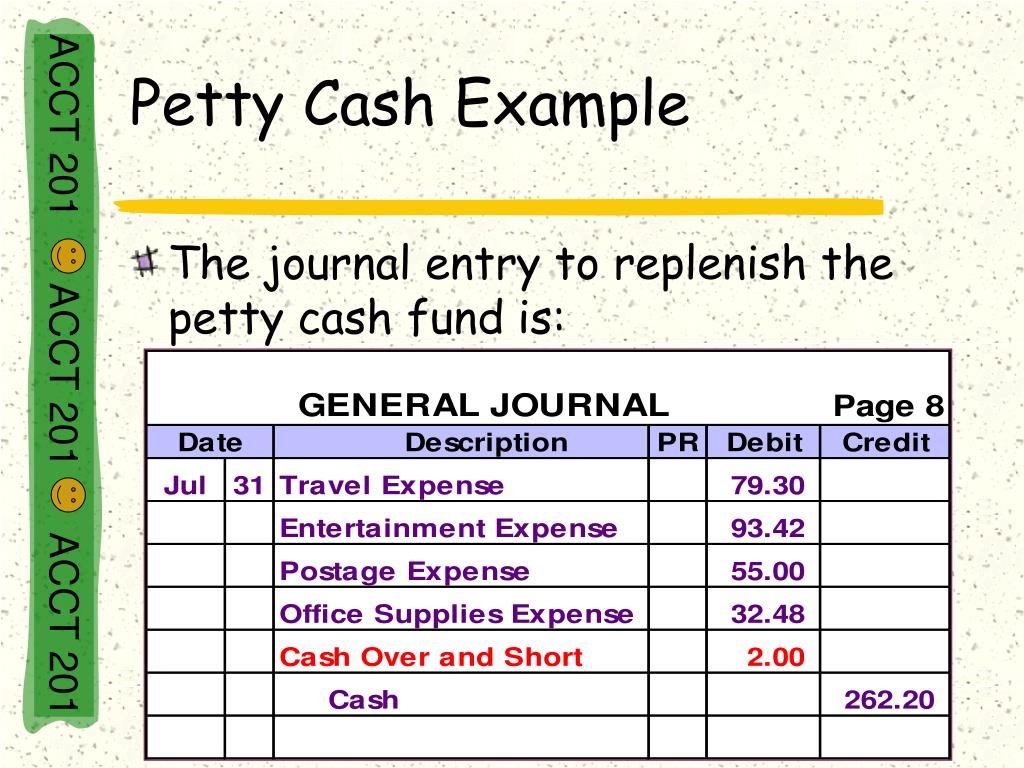

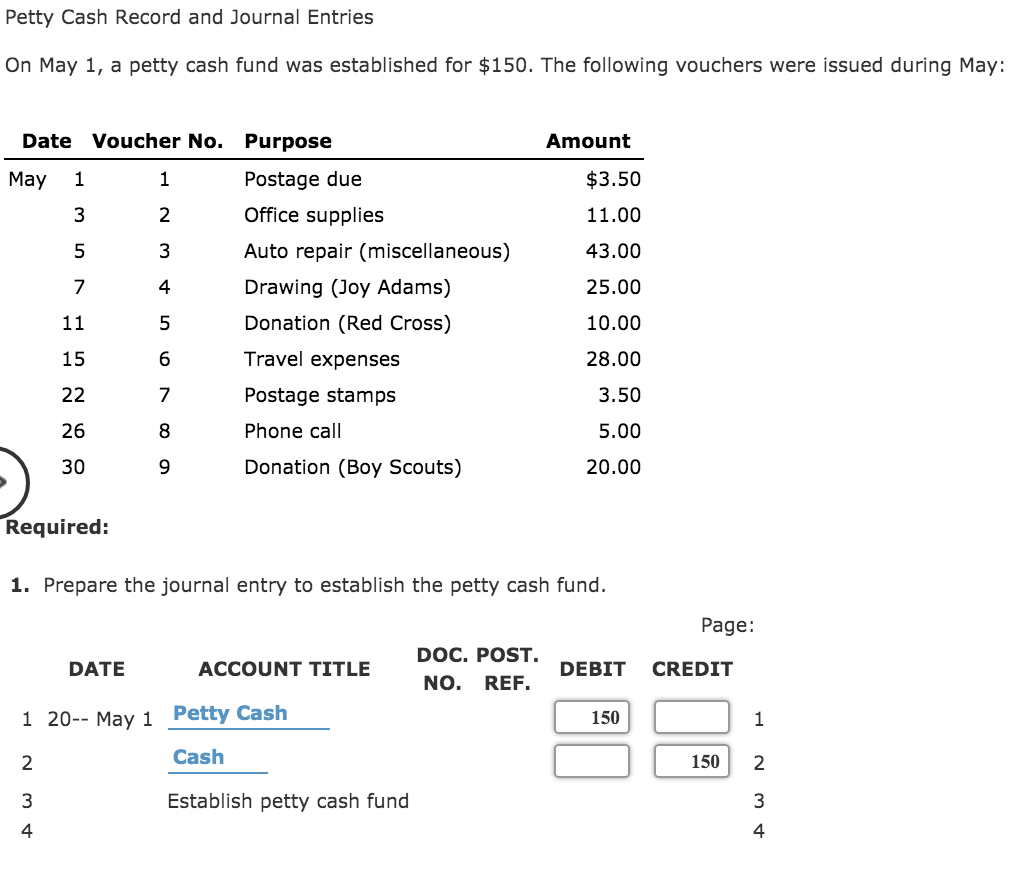

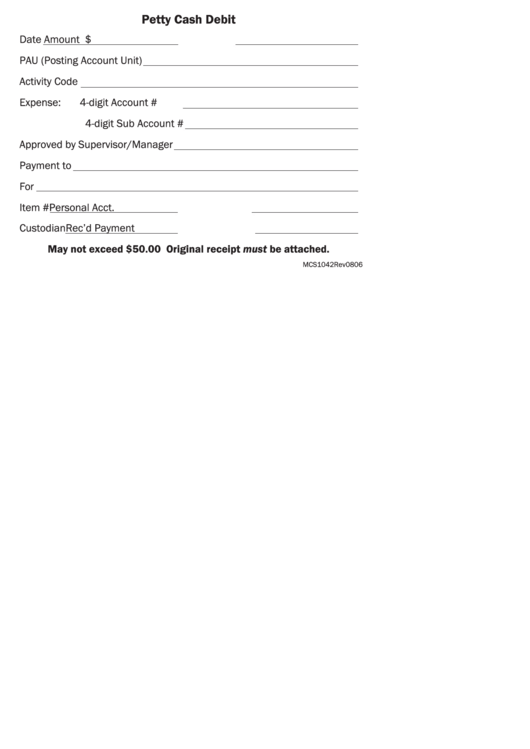

The initial petty cash journal entry is a debit to the petty cash account and a credit to the cash account. The accounts included are the bank, stock, debtors,. On extracting a trial balance, the accountant of ett discovered a suspense account with a debit balance of $1,075 included therein;

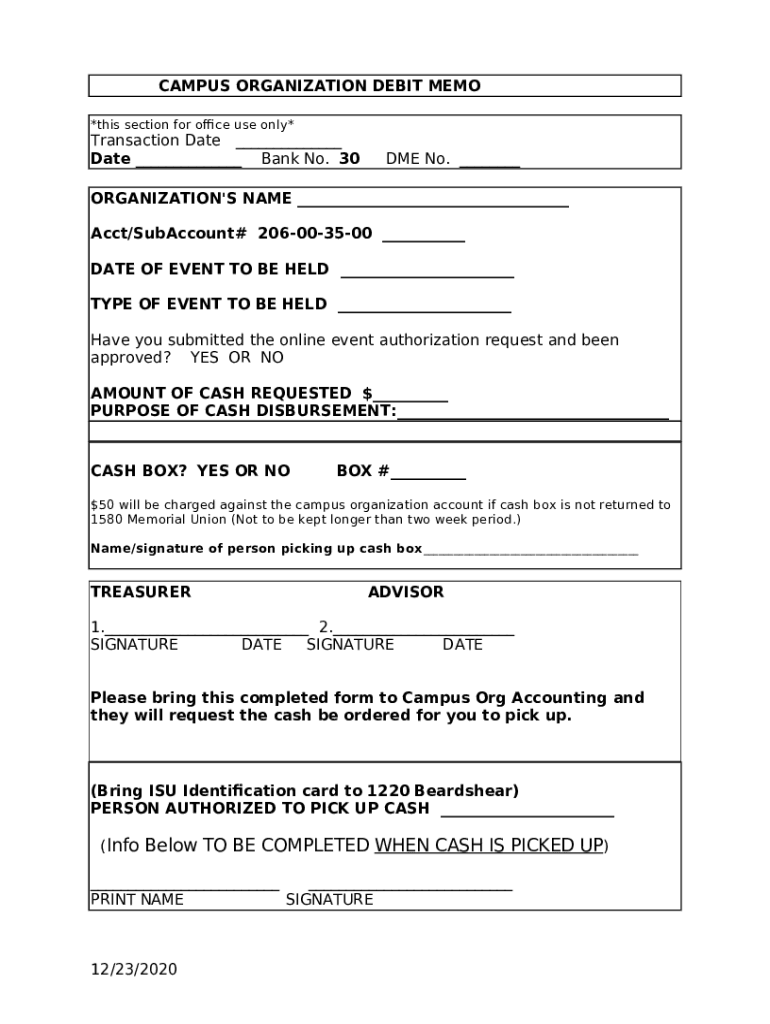

It is used to identify the balance of debits and credits entries. A journal line entry is recorded to an over/short account if there is a shortage or overage. Here is a video of the petty cash process and then we.

Q has completely omitted the. The final total in the debit column must be the same dollar amount that is determined in the final. Once all ledger accounts and their balances are recorded, the debit and credit columns on the trial balance are totaled to see if the figures in each column match each other.

I can't work it out. I'm just working through trial balance question. The petty cash account is a current asset and will have a normal debit balance (debit to increase and credit to decrease).

Remember to record petty cash expenses in your. A debit is written to show. The petty cash custodian then disburses petty cash from.

A trial balance includes the figures from the profit and loss (income statement) and the balance sheet financial statements. A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time. At the end of the period the petty cash float is ‘topped up’ by withdrawing an amount from the bank totalling the petty cash payment made during the.