Top Notch Info About Accrued Expenses Financial Statement

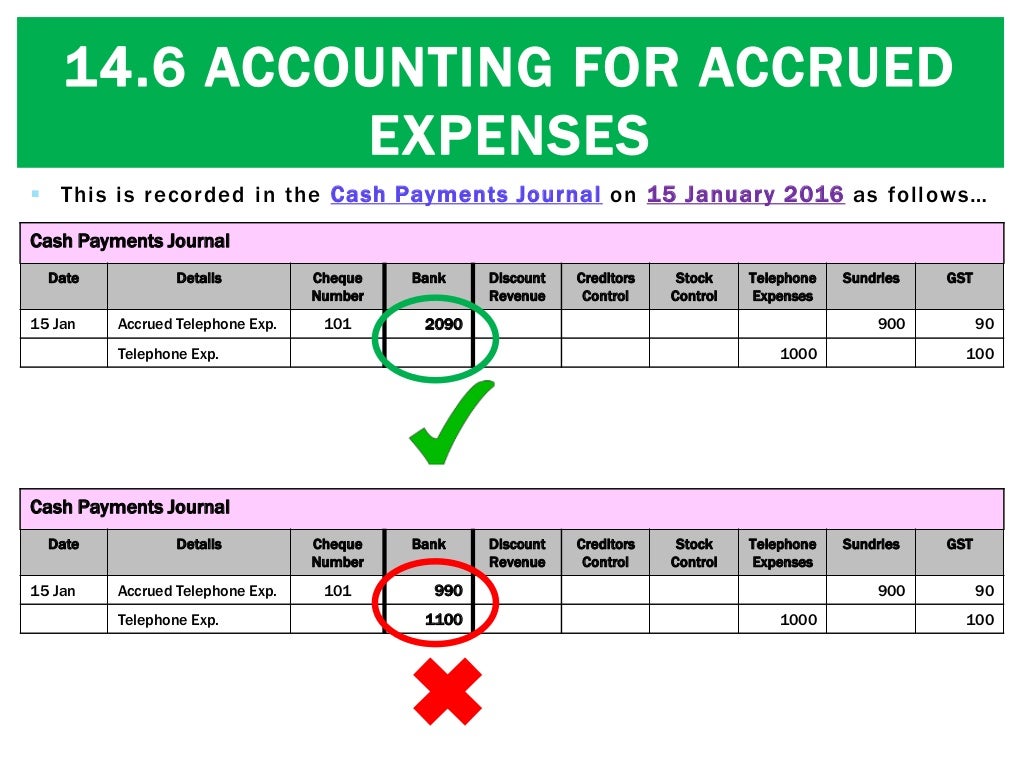

Example of accrued expense journal entry.

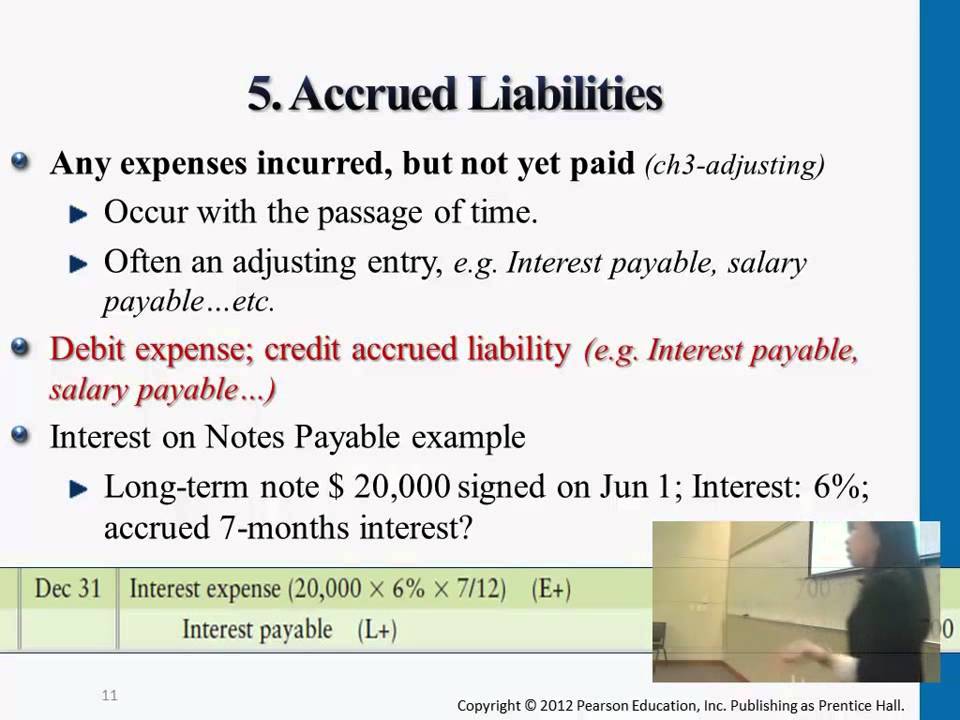

Accrued expenses financial statement. These expenses can include salaries,. Accrued expenses, also known as accrued liabilities, are costs that a company has incurred but has not yet paid. Impact on financial statements.

A new york judge ordered trump and his companies friday to pay $355. Accrual accounting is a method of bookkeeping that records revenues as they are earned and expenses as they are incurred. Explaining accrued expenses.

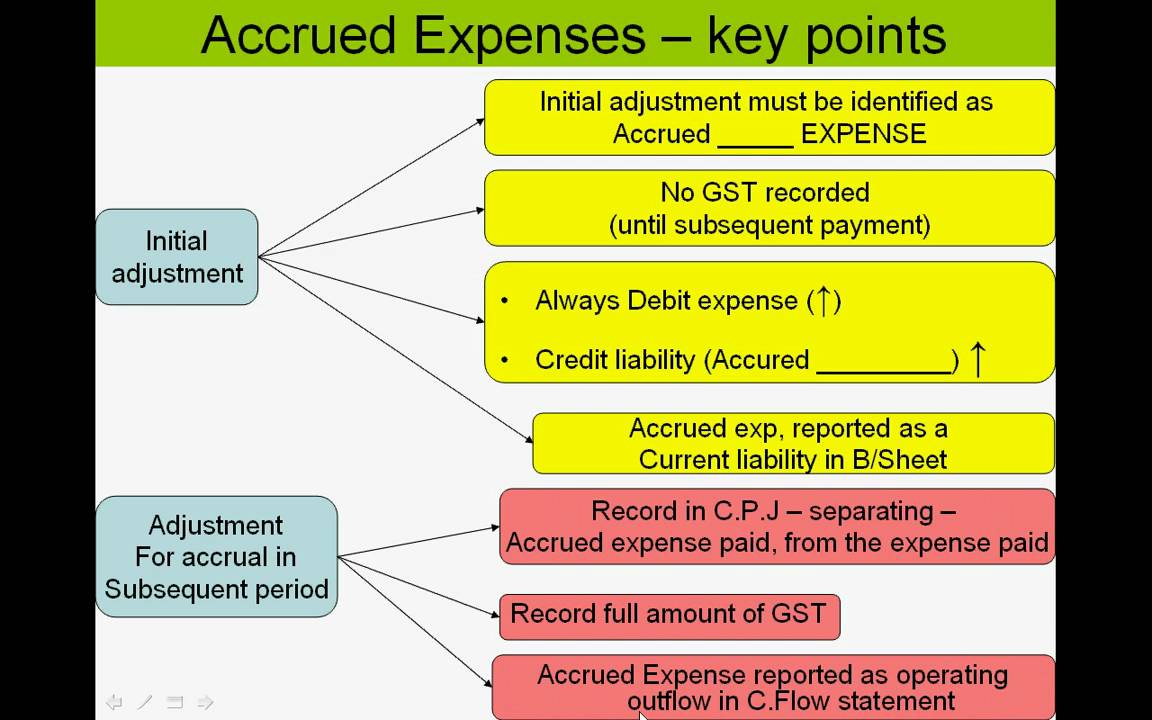

The matching principle of accounting requires. This means these expenses will not appear. Accrued expenses or liabilities occur when expenses take place before the cash is paid.

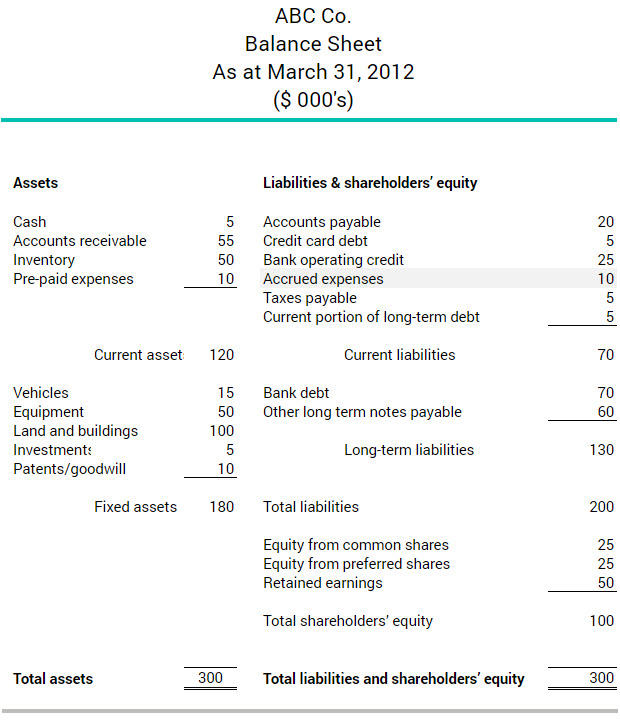

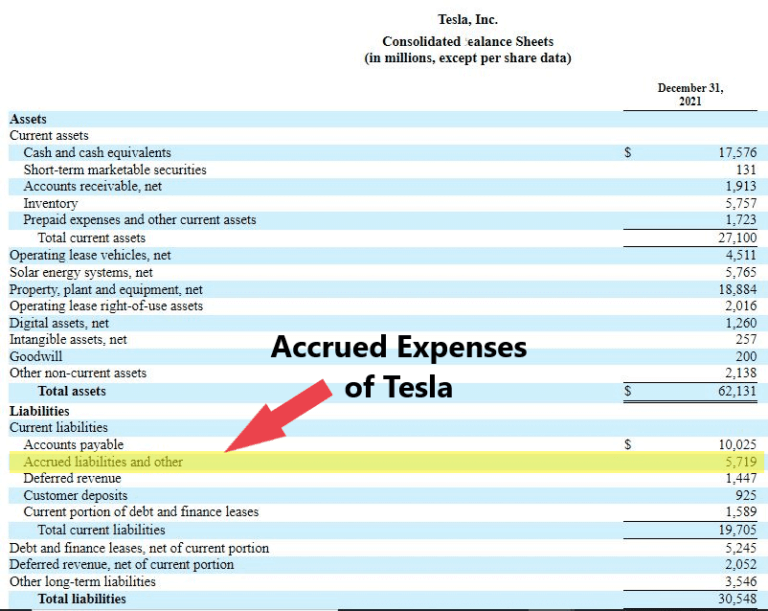

Improves accuracy of financial statement: Accrued expenses are expenses that have occurred but are not yet recorded in the company's general ledger. Accrued expenses are usually current liabilities since the payments are generally due within one year from the.

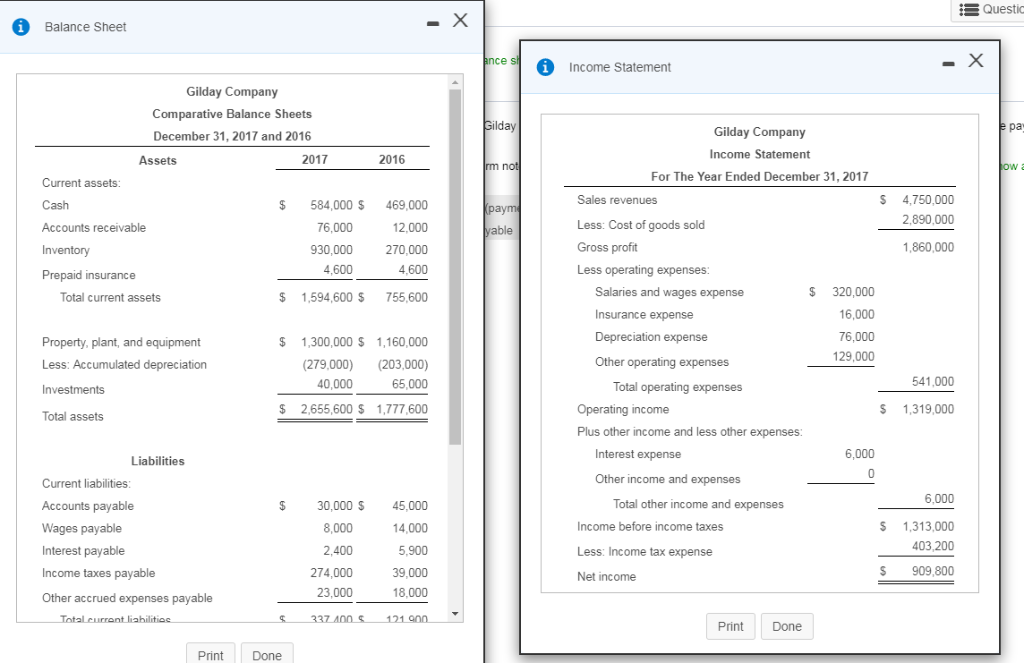

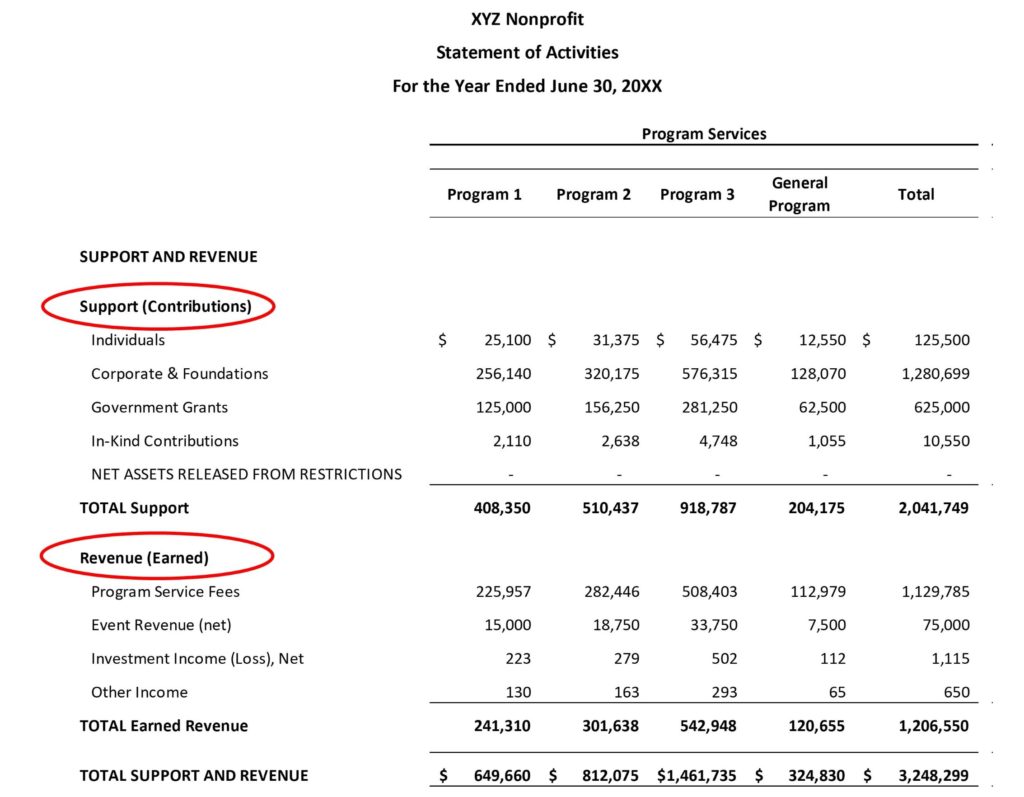

Accrued expenses in financial statements income statement. Accrued expense is recognized in the period of incurrence for which the invoice. These expenses are reflected on the business’s.

The expenses are recorded on an income statement, with a corresponding liability on the balance sheet. Accrued expenses refer to a company’s incurred expenses related to employee wages or utilities yet to be paid off in cash — often due to the invoice not yet. Its purpose is to provide a solid and.

Under accrual accounting, all expenses are to be recorded in financial statements in the period in which they are incurred, which may differ from the period in. The meaning of accrued expenses signifies expenses incurred but not paid by the business during the accounting period. On the income statement, expenses that have been incurred are recognized in the period they.

Accounts payable, on the other hand, are current liabilities that will be paid in the. Accrued expenses are a testament to the complexity of financial accounting, serving as a bridge between accounting periods to. Accrued expenses have a significant impact on a company’s financial statements, particularly the income statement and the balance.

This system also facilitates the stakeholders. A company, xyz ltd, has paid interest on the outstanding term loan of $1,000,000 for march 2018 on 5th april 2018. Accrued expenses, often referred to simply as “accruals,” are financial obligations that a company has incurred but hasn’t paid for yet.

An accrued expense is an expense that has been incurred but not yet paid by the time the books are closed for an accounting period. Significance of accrued expense on the financial statements #1 balance sheet: Accrual accounting helps avoid misstatements in the financial statements, giving a fair view of the financial position.