Unique Tips About Direct Method Operating Cash Flow

More how to use the indirect method to prepare a cash flow statement

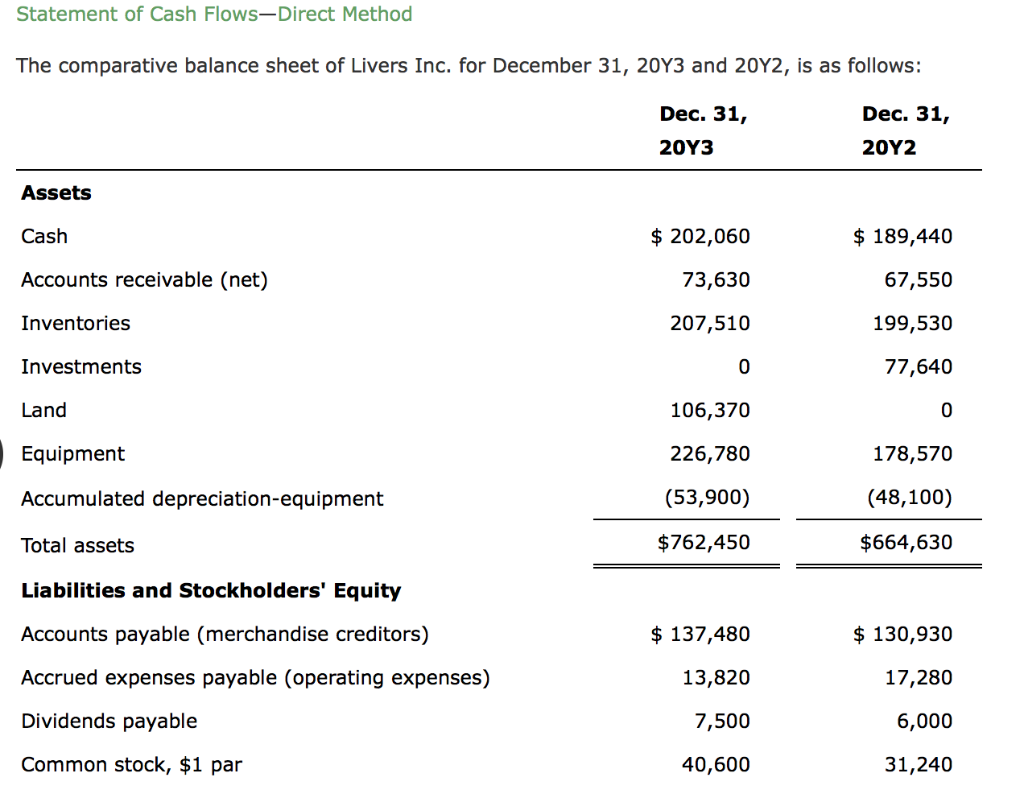

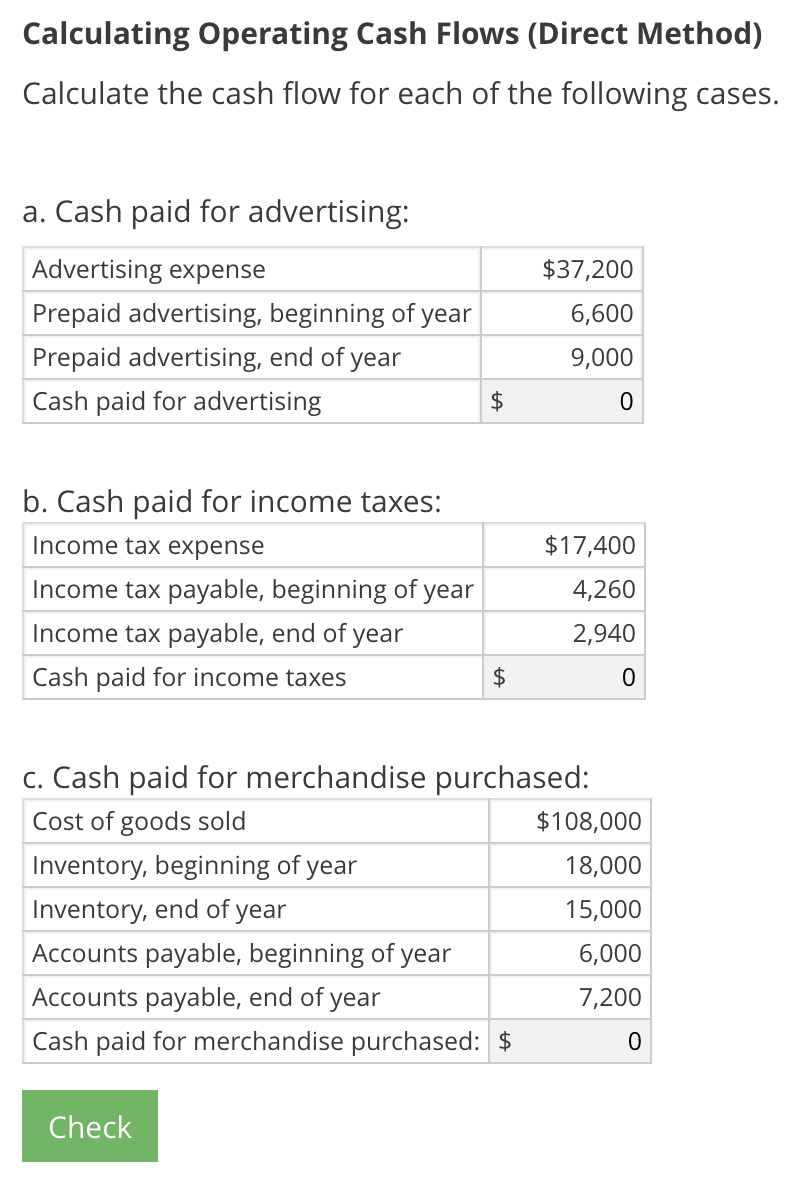

Direct method operating cash flow. This results in a statement of the cash inflows and outflows associated with a variety of line items, such as the following: Explained a cash flow statement contains three sections; The direct method is one of two accounting treatments used to generate a cash flow statement.

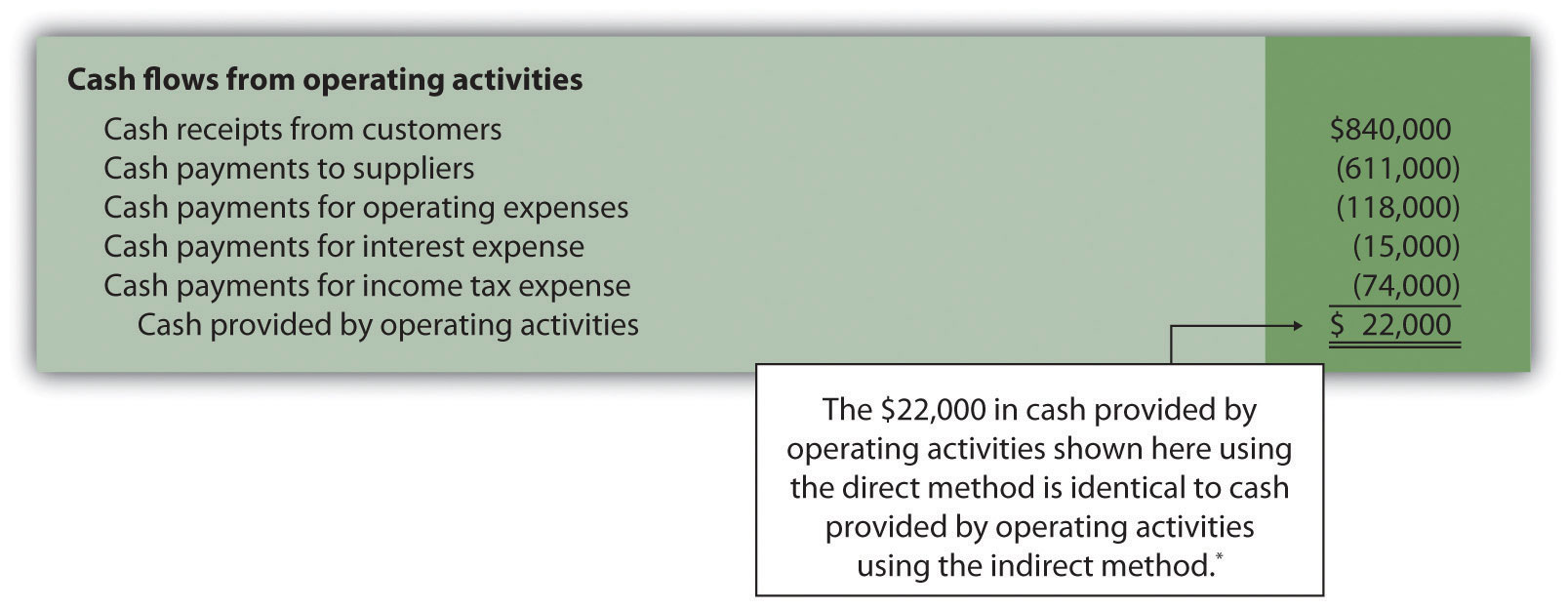

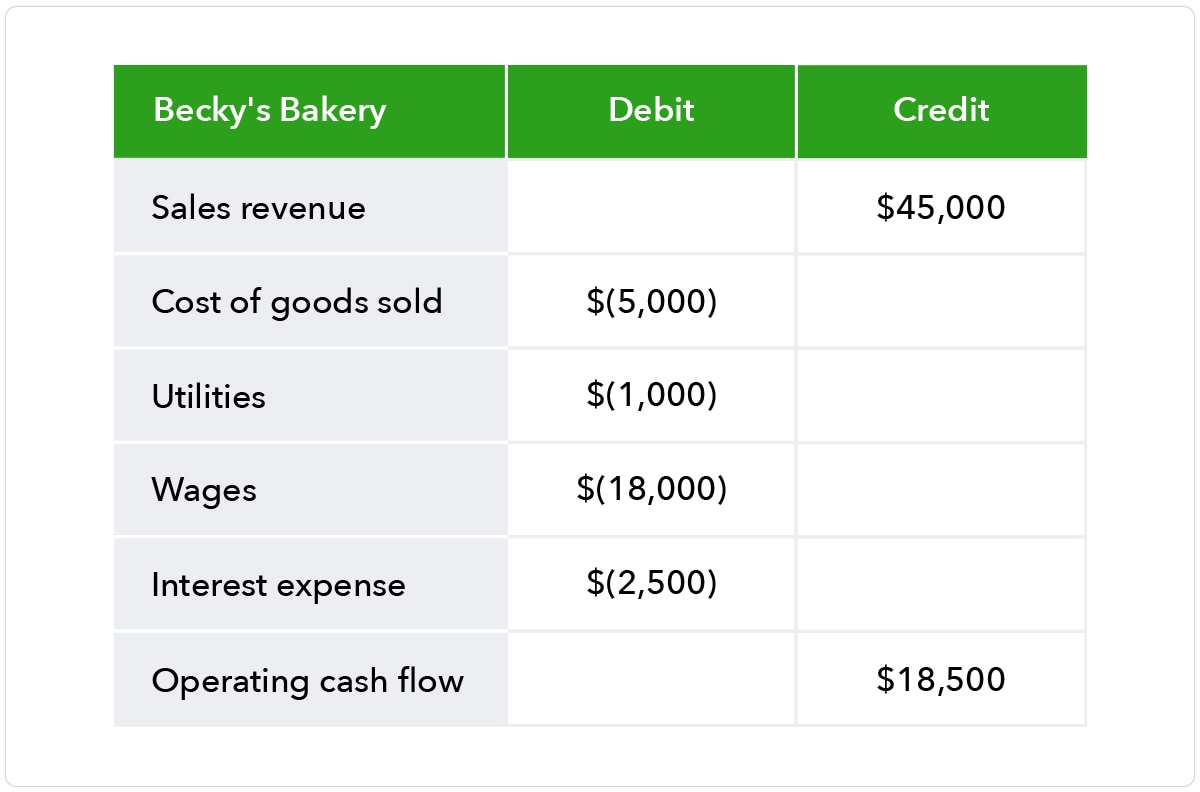

Operating cash flow formula (direct method) the less prevalent approach to calculating ocf is the direct method, which uses cash accounting to track the movement of cash during a specified period. The operating cash flows section of the statement of cash flows under the direct method would appear something like this: This method shows a company’s total operating, financing, and investing cash flow over a set period.

Unlike the indirect method, it directly reports each major cash inflow and outflow, offering a detailed view of cash flows from. The statement of cash flows direct method uses actual cash inflows and outflows from the. Items that typically do so include:

Items that typically do so include: The cash flow statement presented using the direct method is easy to read because it lists all of the major operating cash receipts and payments during the period by source. Cash flows from operating activities:

In other words, it lists where the cash inflows came from, usually customers, and where the cash outflows went, typically employees, vendors, etc. This formula is simple to compute, and it’s often ideal for smaller businesses, partnerships, and sole proprietors. A company can choose the.

It builds the operating section of the cash flow statement directly using each of the cash inflows and outflows from a business’s operations during a given period. Liberto’s income statement reported net income of $100,000. Operating cash flow formula:

In the direct method, we find out actual cash received from customers and cash paid to employees, suppliers and for other operating expenses and we subtract the outflows from the inflows to arrive at the net cash flow. Fasb expressed preference for the direct method but the indirect method is used by most businesses in the united states. There are two ways to calculate the cash flow from operations which are the direct method and the indirect method.

For operating cash flows, the direct method of presentation is encouraged, but the indirect method is acceptable [ias 7.18] the direct method shows each major class of gross cash receipts and gross cash payments. Under the direct method, the information contained in the company's accounting records is used to calculate the net cfo. Operating cash flow (ocf) is a measure of the amount of cash generated by a company's normal business operations.

The cashflow direct method formula is as follows. We can work out the cash flow from operations using two methods: Cash flows from operating activities:

There are two ways to prepare the cash flow statements. Operating cash flow (ocf) is a measure of the amount of cash generated by a company's normal business operations. (a) the direct method and (b) the indirect method.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-02-c2254626b9bb4e8eacbfaf47e4e83784.jpg)