Beautiful Work Tips About Expense Income Statement

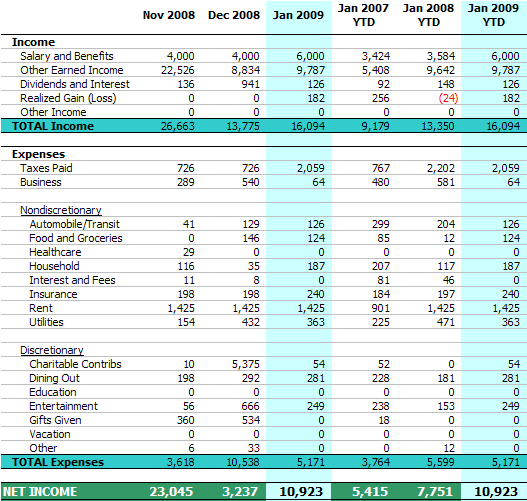

By regularly analyzing your income statements, you can gather key financial insights about your company, such as areas for improvement or projections for future performance.

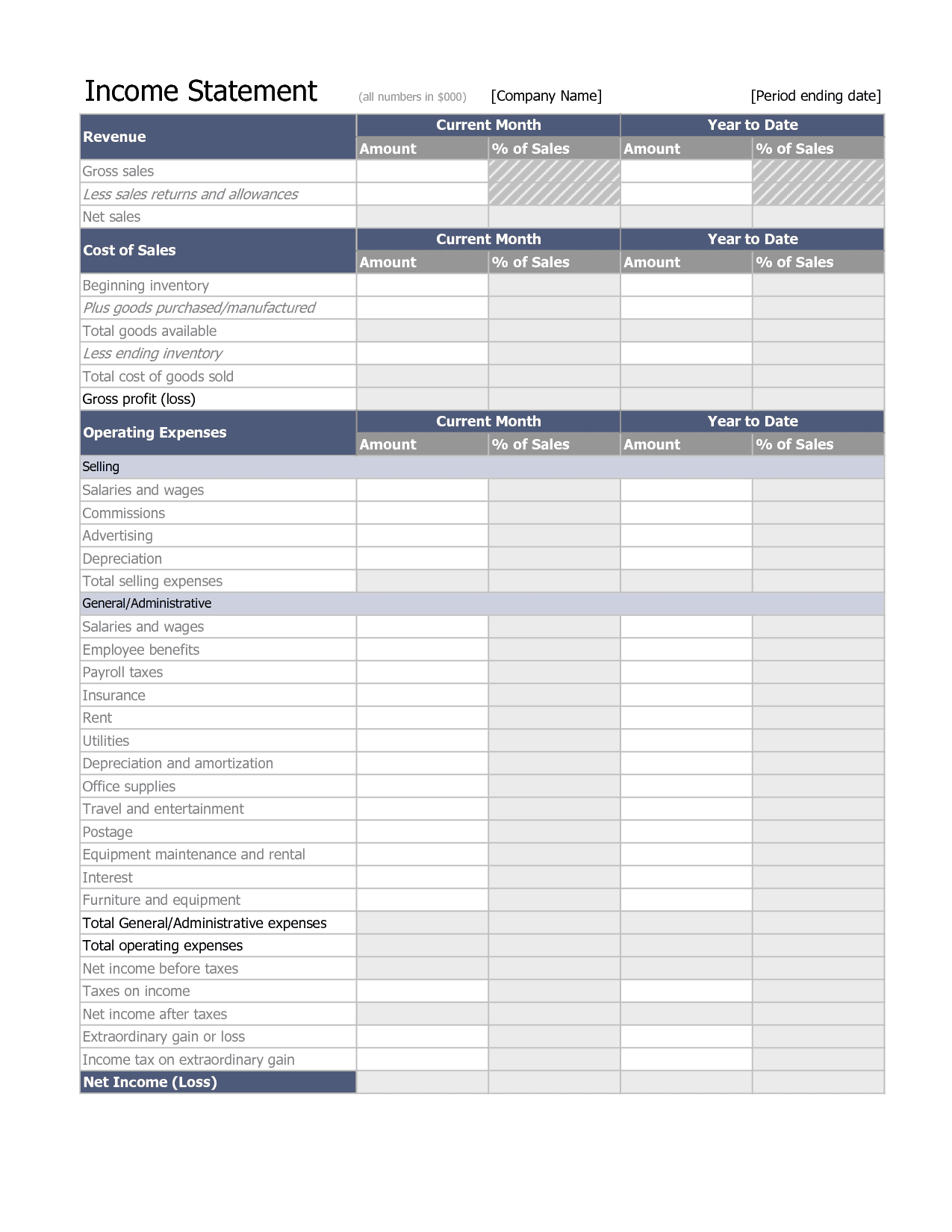

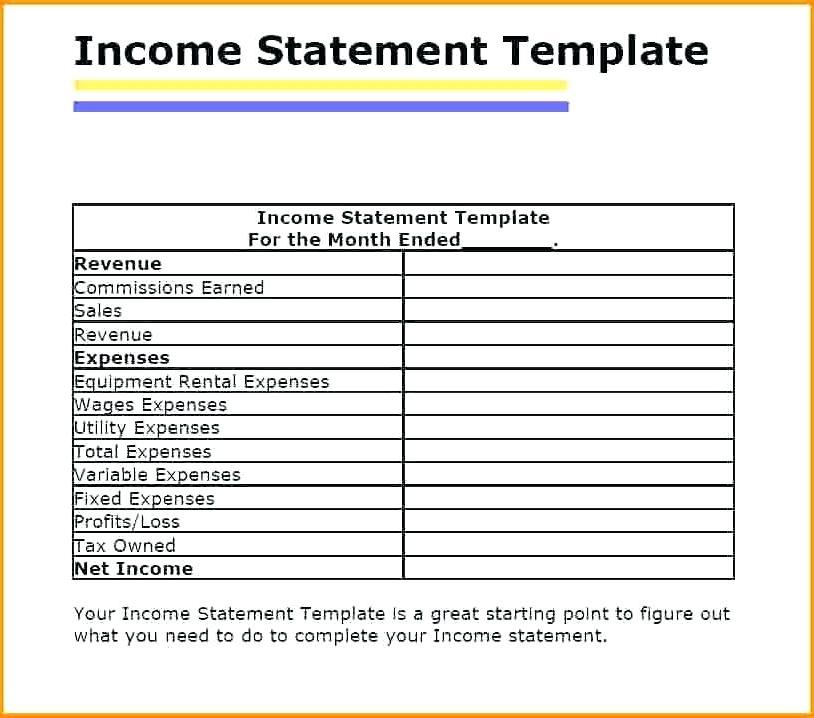

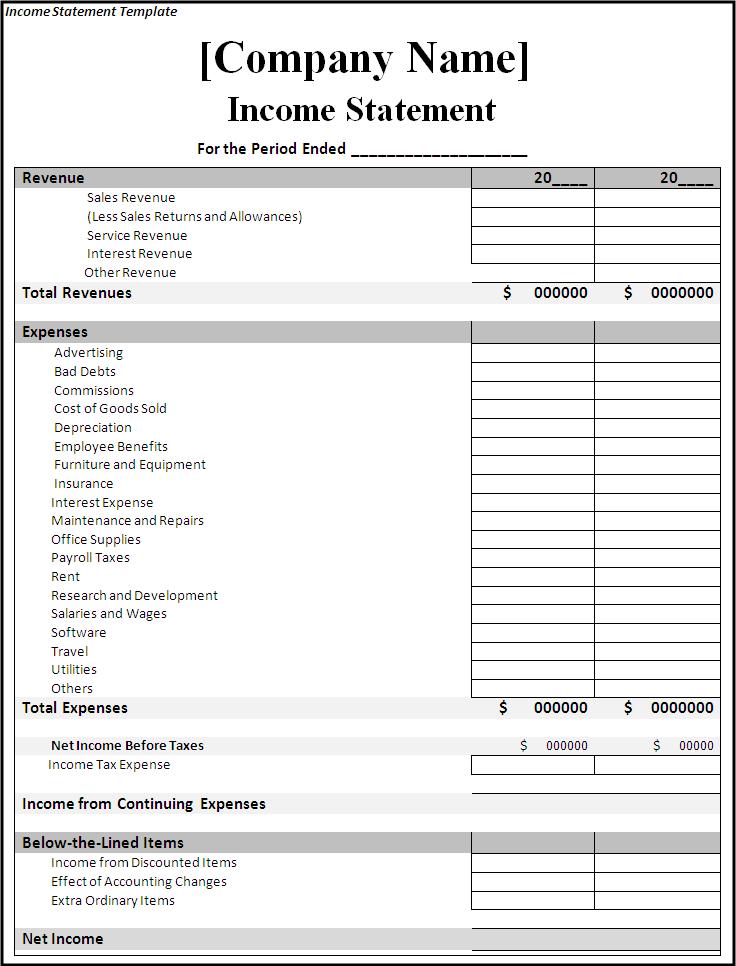

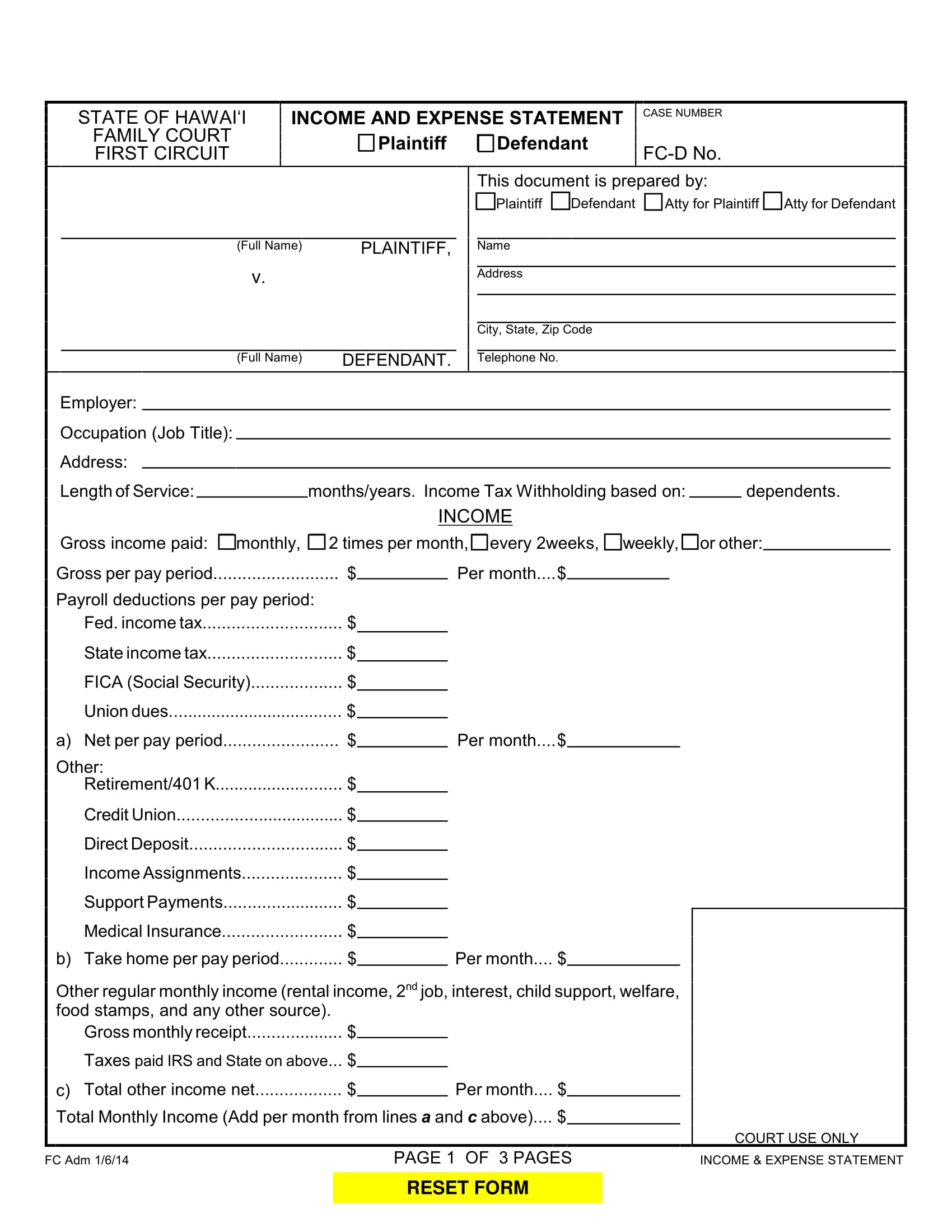

Expense income statement. The income statement, also called the profit and loss statement, is a report that shows the income, expenses, and resulting profits or losses of a company during a specific time period. Accounting & taxes. A balance sheet, on the other hand, only lists the fiscal situation on a specific date.

The income statement is an essential part of the financial statements that an organization releases. The basic equation underlying the income statement, ignoring gains and losses, is revenue minus expenses equals net income. How to read and understand income statements as a small business

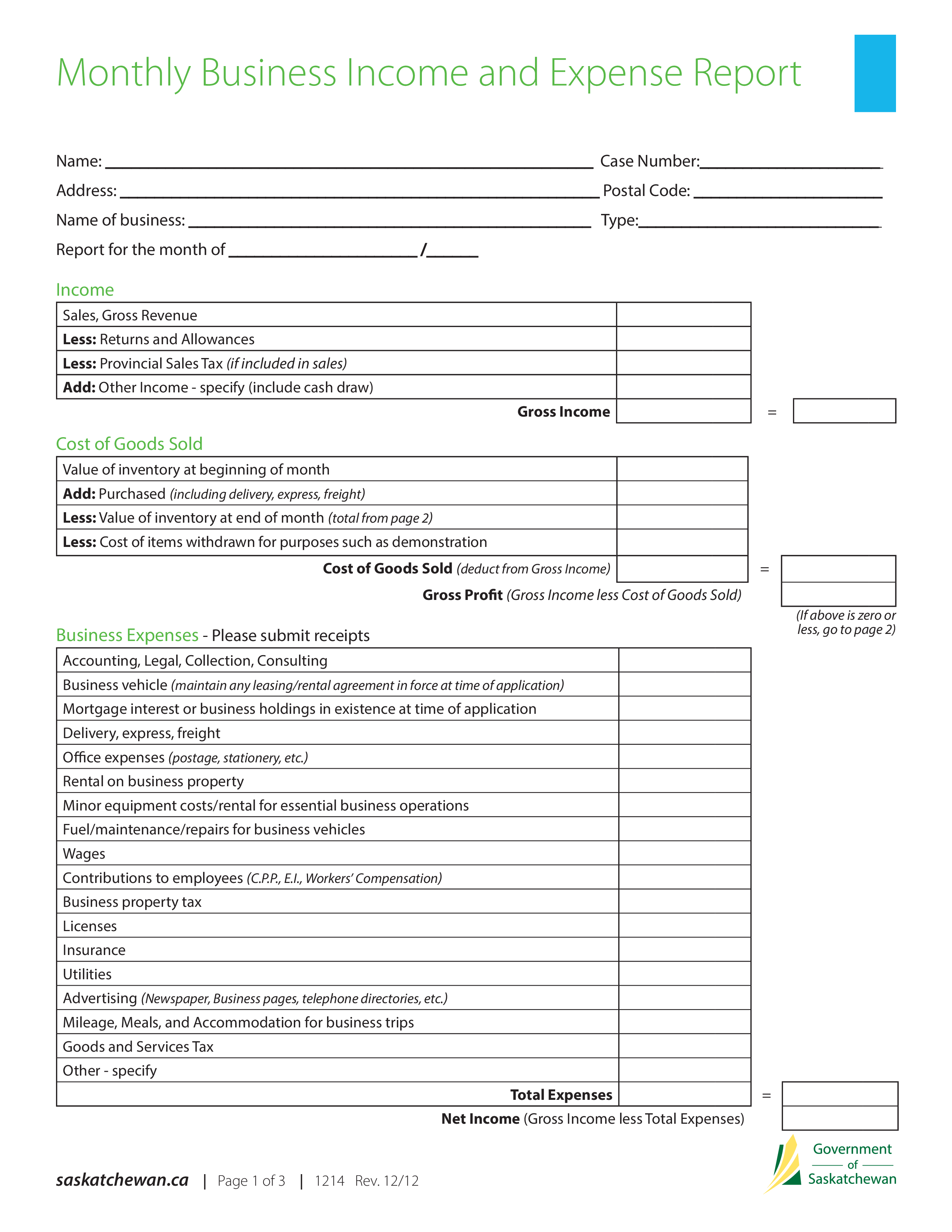

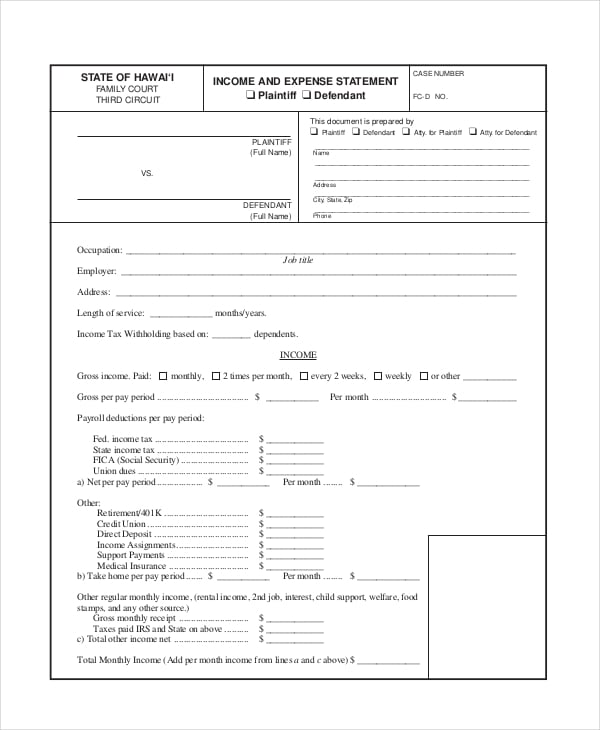

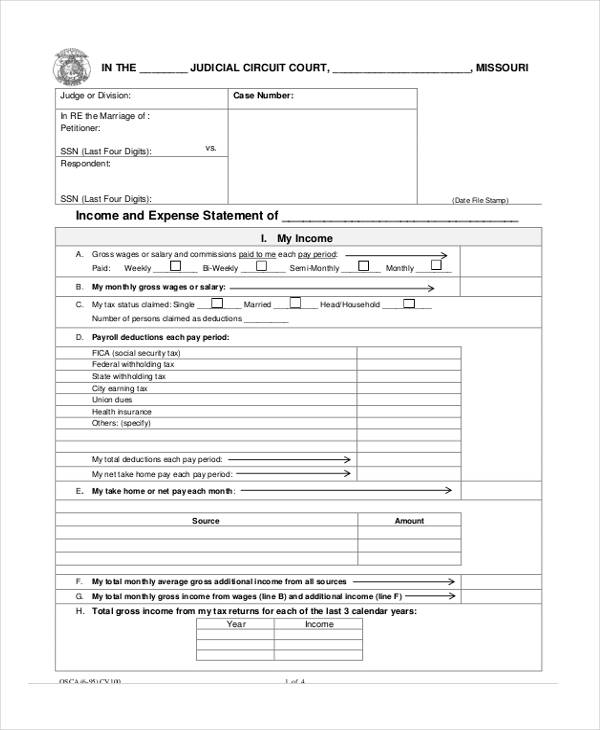

Some of the common expenses recorded in the income statement include equipment depreciation, employee wages, and supplier payments. The income statement can either be prepared in report format or account format. Definition of salaries and wages salaries and wages are forms of compensation paid to employees of a company.

An income statement might use the cash basis or the accrual basis. Revenue minus expenses equals profit or loss. The balance sheet while the definition of an income statement may remind you of a balance sheet, the two documents are designed for different uses.

Types of expenses as the diagram above illustrates, there are several types of expenses. Due to the accrual principle in accounting, expenses are recognized when they are incurred, not necessarily when they are paid for. David kindness fact checked by timothy li what is an expense?

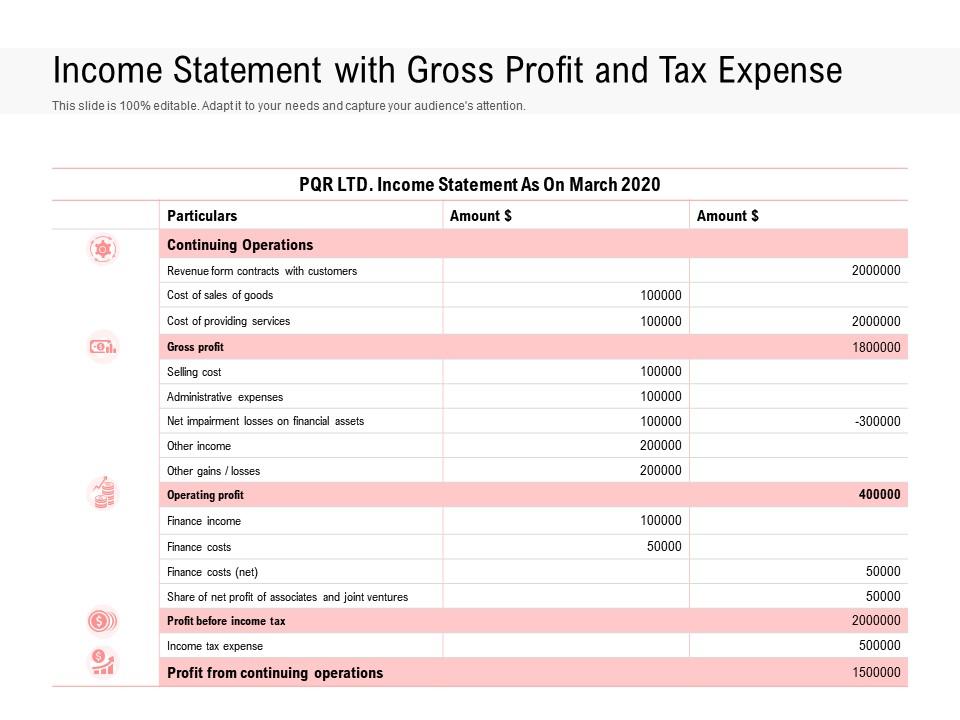

It had revenue and gains of $500,000 and expenses and losses of $90,000 for the entire year. An income statement summarizes a company's financial performance. The income statement is also sometimes referred to as.

Net income is the profit that remains after all expenses and costs, such as taxes. A balance sheet, on the other hand, records assets, liabilities, and equity. Many key fundamental ratios use information from the income statement.

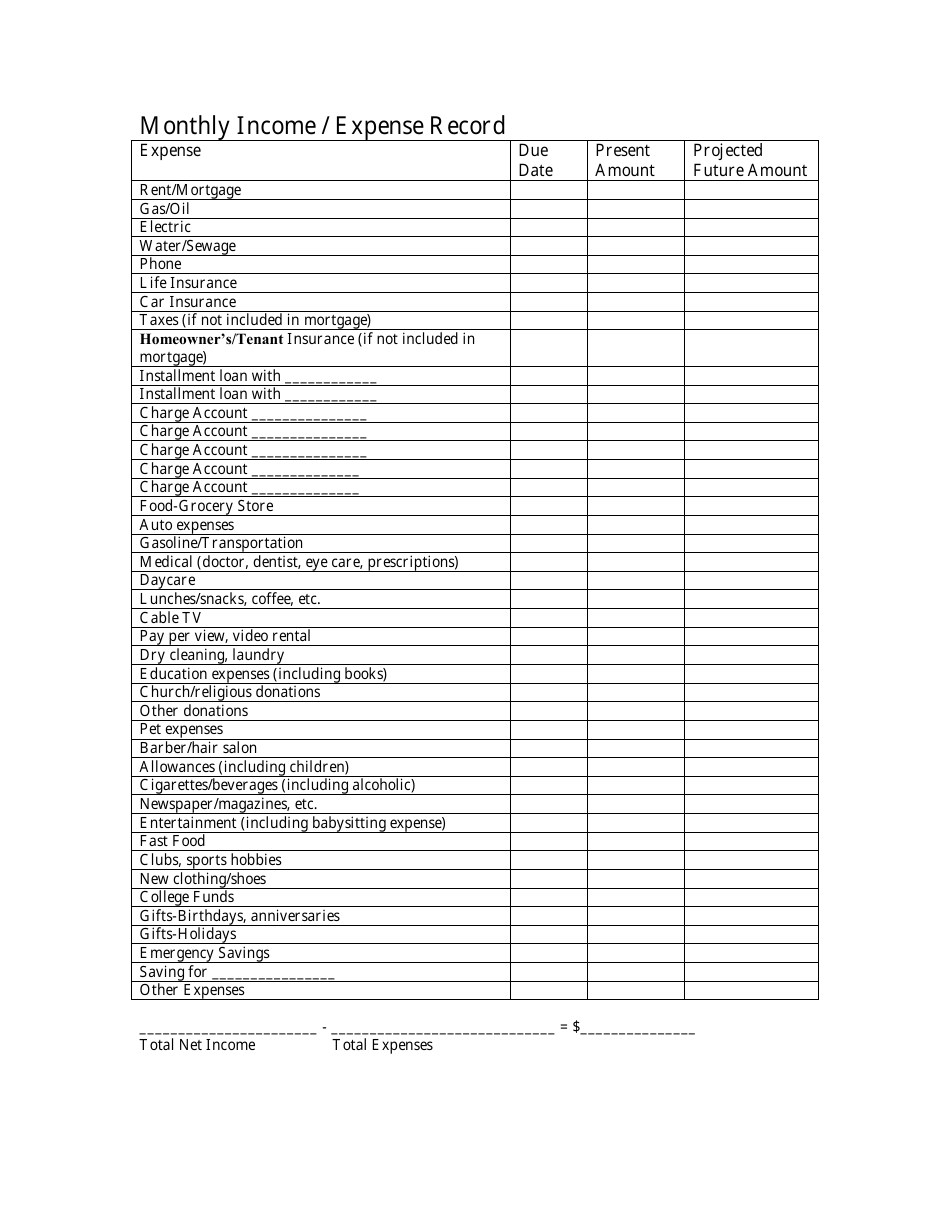

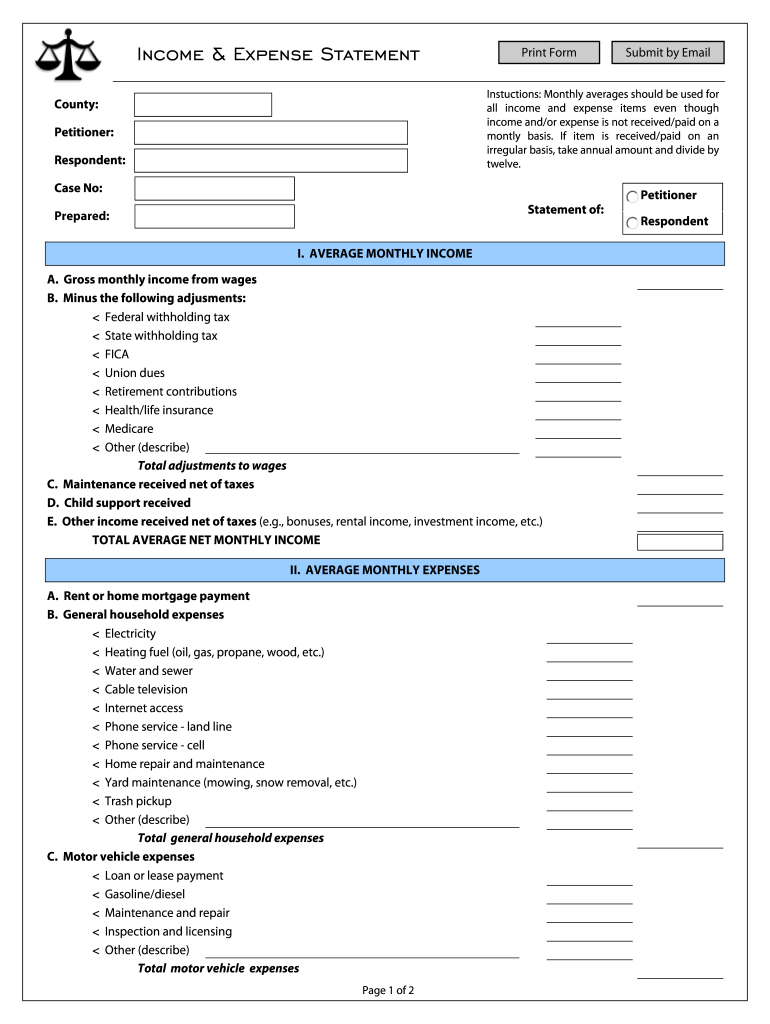

An income statement typically includes the following information: The total costs associated with component parts of whatever product. It is simply defined as the cost one is required to.

You can look at an income statement for just one day or over a month, a quarter, a year, or several years. You can learn about the health of a business—up and down, and across time—by looking at its income statement. Gross profit represents the income or profit remaining after production costs have been subtracted from revenue.

It’s one of the most important financial statements for small business owners, so it’s key to understand what an income statement is, what its purpose is, and. Year ended december 31, 2022 year ended june 30, 2022 nine months ended september 30, 2022 In the income statement, expenses are costs incurred by a business to generate revenue.